Renters Insurance in and around Houston

Renters of Houston, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Trying to sift through providers and savings options on top of keeping up with friends, work and your pickleball league, can be a lot to juggle. But your belongings in your rented property may need the terrific coverage that State Farm provides. So when trouble knocks on your door, your tools, home gadgets and souvenirs have protection.

Renters of Houston, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

There's No Place Like Home

Renters insurance may seem like last on your list of priorities, and you're wondering if having it is actually beneficial. But take a moment to think about what would happen if you had to replace all the personal property in your rented condo. State Farm's Renters insurance can help when unexpected mishaps damage your valuables.

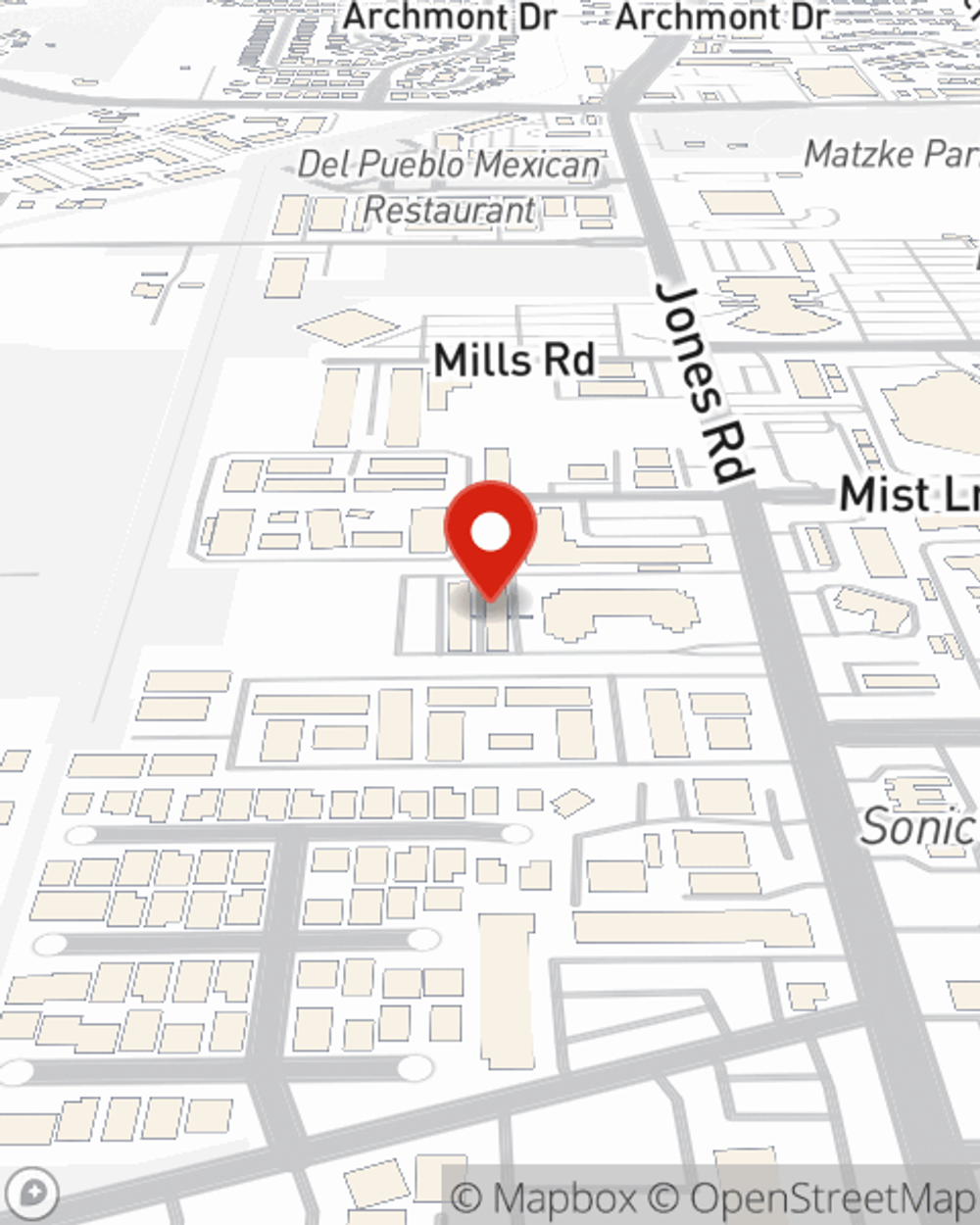

If you're looking for a dependable provider that can help you protect your belongings and save, call or email State Farm agent Roderick Price today.

Have More Questions About Renters Insurance?

Call Roderick at (281) 469-7055 or visit our FAQ page.

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Roderick Price

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.